In this article, you’ll learn:

In a physical store, a shopper scans the aisle, glances at the shelves, and grabs Tide in 15 seconds. Online, they scroll through an endless stream of product listings—and your premium detergent might be buried on page three while a generic brand holds the “Amazon’s Choice” badge. That’s the digital shelf.

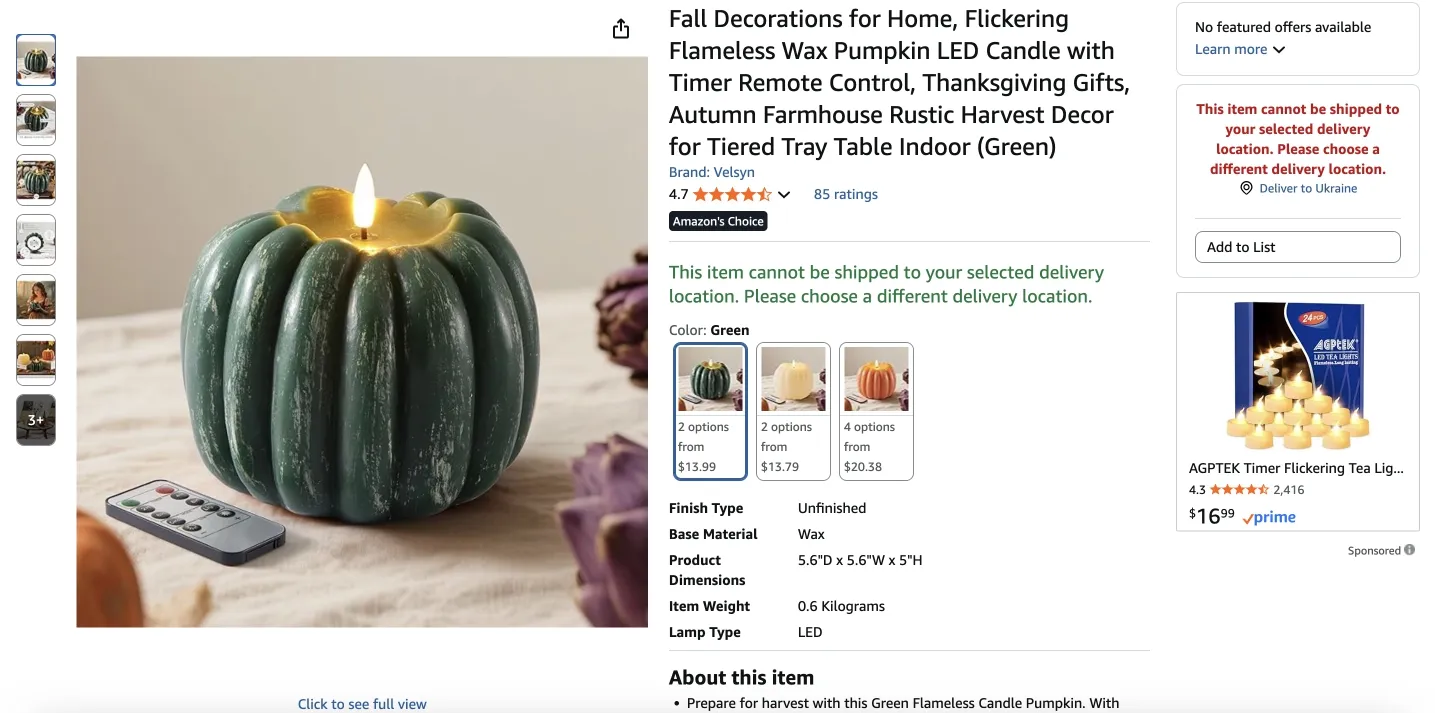

The digital shelf is your product’s full online footprint across digital channels: search results in search engines, category pages, PDPs, images, product descriptions, prices, and customer reviews on retailer websites, marketplaces, and your own DTC store. Unlike physical store shelves, your digital shelf presence is dynamic and algorithm-driven—shifting constantly based on content, product visibility, stock, and performance.

In this article, we’ll unpack what a digital shelf strategy looks like, which levers actually move digital shelf performance, and how to use digital shelf analytics and day-to-day digital shelf management to build a presence that consistently wins the click.

Key Takeaways

| Topic | Key takeaway | Why it matters | What to do first |

|---|---|---|---|

| Presence ≠ performance | Having listings live doesn’t mean you’re winning. If you don’t rank, convert, or hold the Buy Box, you’re invisible. | Many brands think “we’re on Amazon” is enough and miss the revenue leaking through weak execution. | For 5–10 hero SKUs, check: rank, conversion rate, rating, review count, stock history, price vs top competitors. |

| Search & visibility | Search rank is the front door. If you’re not on page one for key terms, most shoppers never see you. | Most clicks go to the first few results; page two is basically “no man’s land.” | Identify your top 10–20 high-intent keywords per channel and track your rank for them at least weekly. |

| Content & conversion | PDPs are landing pages. Titles, bullets, images, video, and attributes decide whether clicks turn into orders. | Better content = higher conversion = stronger ranking signals. Weak content does the opposite. | Take your top 5 SKUs and upgrade PDPs: clear titles, full specs, 5–7 images, 1 short video, FAQ/Q&A cleanup. |

| Availability & operations | Out of stock doesn’t just lose sales today — it also hurts rankings and is slow to recover. | You can’t win the shelf if your products aren’t reliably available where people shop. | Track in-stock rate for key SKUs per channel; set alerts or simple rules so OOS gets fixed fast. |

| Data foundation (PIM/DAM) | Without a single source of truth for product data and assets, every update is slow, manual, and inconsistent. | Dirty, scattered data kills speed, breaks listings, and makes optimization painful. | Map where product info lives today. Start consolidating to (or planning) a PIM + DAM as your backbone. |

| Reviews & Q&A | Ratings, review volume, and answered questions are core trust and ranking signals. | Low ratings or too few reviews can sink even a good product; fresh reviews keep you relevant. | Set up simple, automated review requests and a habit of answering Q&A and key negative reviews. |

| Pricing & promotions | Price shapes both shopper choice and algorithm favorability. Promos should create momentum, not just margin loss. | Overpriced vs peers = fewer clicks and sales; permanent discounts = trained bargain hunters. | For key SKUs, compare your price against top 3–5 competitors and define basic rules for when to discount. |

| Retail media | Ads should amplify listings that already convert, not compensate for bad PDPs. | Paying for clicks to weak pages just wastes budget and sends bad conversion signals. | Audit your top ad destinations: pause spend on PDPs with poor content/rating until you fix the fundamentals. |

| Continuous optimization | The digital shelf moves constantly; treating it as a one-time project guarantees you fall behind. | Competitors, algorithms, and shopper behavior don’t sit still. You can’t either. | Create a simple monthly or bi-weekly routine: review rankings, content gaps, reviews, pricing, and stock — and assign owners to fixes. |

What is the digital shelf?

The digital shelf is your product’s complete online presence across e-commerce platforms—everything that affects whether shoppers find, click, and buy.

It includes how you show up in search and categories, how you write your titles, bullets, descriptions, and attributes, what your images and videos look like, how you price and promote, how strong your reviews and Q&A are, and whether products are actually in stock when people want to buy. Comparison tools and “similar items” carousels matter too: they decide who sits next to you when a shopper is picking.

Unlike a fixed in-store shelf, your placement online is algorithmic and volatile. Keyword relevance, conversion rate, review quality, price competitiveness, inventory, and media all play a role. A competitor can update content, drop price, or launch a promo and leapfrog you overnight. Managing the digital shelf means treating all these elements as a single system and continuously tuning them—not setting it once and walking away.

From physical shelf to digital shelf

In traditional retail, “the shelf” meant a specific location: the right aisle, the right height, the right neighbors. You negotiated a spot, stocked it, and usually kept it until the next reset.

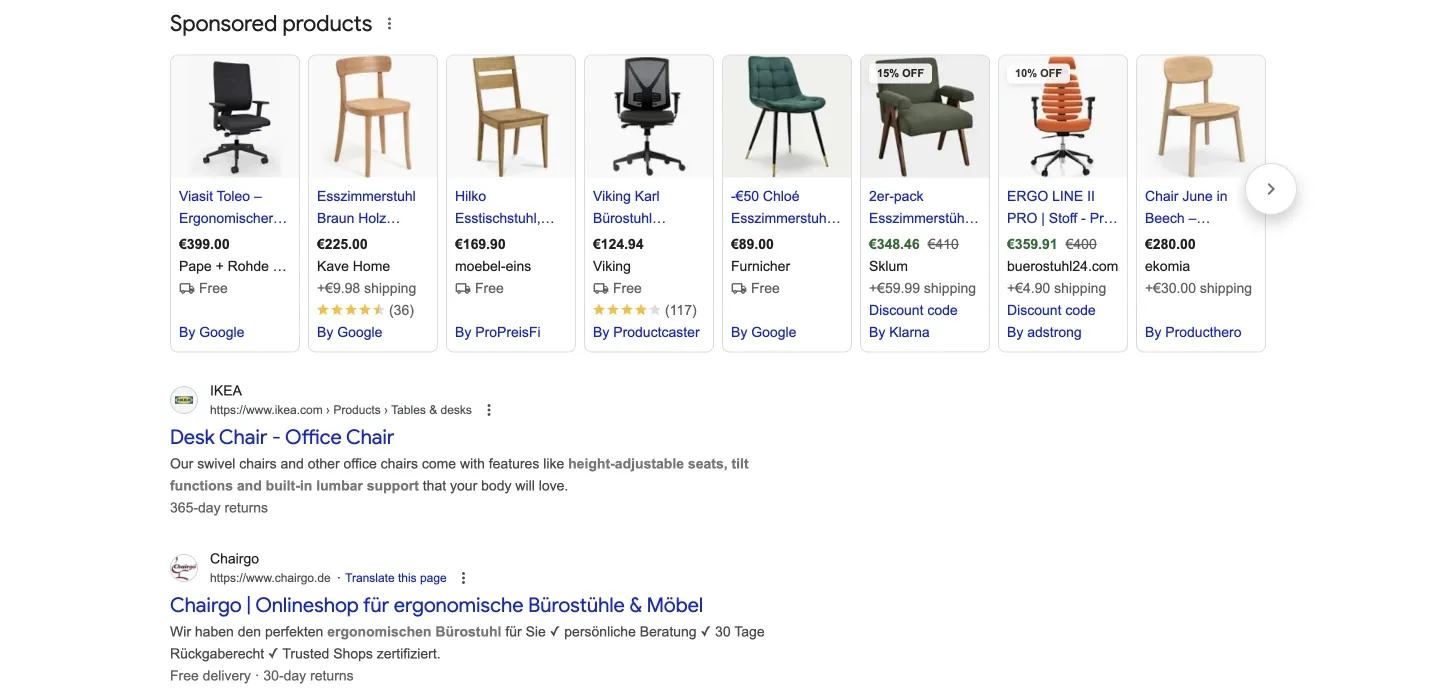

Online, the shelf is any shoppable surface where your product can appear and be bought: marketplaces and retailer sites, search engines and shopping feeds, your own DTC store, and social or live-shopping surfaces where a single tap takes you to checkout.

You’re still fighting for visibility and attention, but the tools have changed. Instead of negotiating endcaps, you’re working with search algorithms, content standards, and retail media budgets. If the algorithm does not surface you, you’re not really “on the shelf” at all.

What is a digital shelf strategy?

A digital shelf strategy is your plan for structuring, monitoring, and improving your digital shelf presence across all key digital channels. Where traditional shelf strategy focused on planograms and endcaps in physical stores, a digital shelf strategy aligns content, pricing strategies, inventory management, and advertising strategies across Amazon, retailer websites, social media platforms, and your own DTC site.

A strong digital shelf strategy connects three things:

- How you present products online (titles, high-quality images, accurate product details, and consistent product descriptions),

- How you drive product discoverability and search rankings with SEO and retail media,

- How you use data analytics and digital shelf data to track key metrics like conversion rates, product performance, and customer engagement.

Brands with a successful digital shelf strategy use digital shelf optimization and digital shelf analytics tools to keep their shelf up to date, reflect real-world market trends and shopper behavior, and deliver a more consistent, trustworthy experience than competitors. That’s what turns a basic presence into a winning digital shelf strategy.

Why the digital shelf became a core battlefield

Having listings live on Amazon or Walmart used to feel like a big step. Now it’s just table stakes. A considerable share of product searches starts on Amazon or Google, not on brand websites. If you don’t perform well on the digital shelf, shoppers simply never put you in their mental shortlist—even if your product is better.

Visibility & traffic

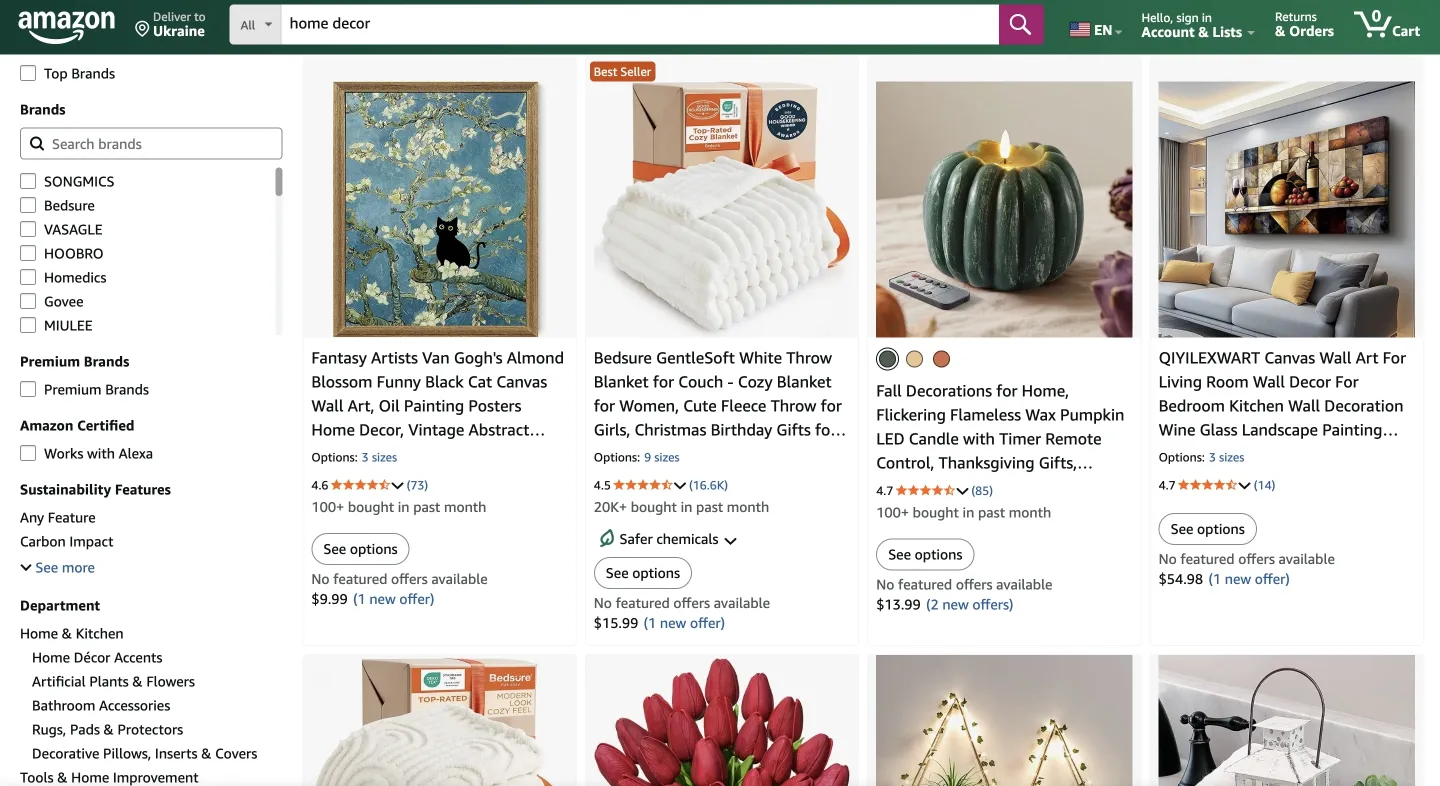

Online, you’re either on page one or you’re mostly ignored. Most clicks go to the first few search results; by page two, click-through rates collapse. If you don’t rank for the high-intent terms in your category, people never even evaluate your offer.

Algorithms reward products with substantial sales velocity, healthy conversion, relevant and complete content, consistent stock, and competitive pricing. When those slip, you fall into a familiar loop: low visibility – low sales – worse rankings – even lower visibility.

Conversion, loyalty & returns

Traffic alone doesn’t pay the bills. Once shoppers land on a PDP, they decide in seconds.

Conversion suffers when images are low-quality or too few, descriptions are thin or miss key specs, reviews are weak or outdated, or your price doesn’t feel justified versus alternatives. That doesn’t just mean fewer orders; it also drives returns, because customers buy the wrong item or feel misled.

Typical example: a fashion brand adds true-to-scale photos, clear size charts, and a “fits small/true to size / runs large” label based on reviews. Conversion rises a couple of points, while returns for “wrong size/fit” drop—without a single change in ad spend.

Operations & speed

The digital shelf has also changed how fast brands have to move. If your product data and assets are ready, you can launch a SKU across multiple channels in days, not months.

Brands that centralize product data, syndicate it cleanly, and monitor stock in real time can react to trends quickly, capture demand when a competitor goes out of stock or raises prices, and fix broken listings before rankings tank. Operational speed on the digital shelf is now a revenue lever, not just a back-office concern.

What actually lives on your digital shelf

Your digital shelf is a network of touchpoints. Marketplaces like Amazon, Walmart.com, Target+, eBay, and Instacart are where much high-intent shopping occurs. Shoppers arrive to search, compare, and buy. Algorithms decide which products show up at the top when they type or tap.

Retailer websites such as Best Buy, Home Depot, Ulta, or CVS often sit between online and offline: people might research online and then buy in-store, or see something in-store and look it up online. If prices, specs, or availability don’t match across those touchpoints, trust erodes quickly.

Your DTC site is the one place you fully control. You own the story, the UX, and the margin. But you also own the traffic problem: if customers can’t discover you through search, social, or campaigns, the best-designed site in the world won’t save you.

Social and content-driven commerce—Instagram Shopping, TikTok Shop, Pinterest, creator storefronts—is where a lot of discovery happens. Creating social media posts is the solution to pave the way for this discovery. Content and UGC have to stop the scroll and make it effortless to add to the cart.

Mobile and delivery apps, whether retailer loyalty apps or services like DoorDash and Uber Eats, have become the default for many repeat or convenience purchases. If your product data isn’t optimized for mobile UX, a big chunk of your audience will never really see you.

For wholesale-oriented brands, B2B portals such as Faire, Abound, and Alibaba, as well as vertical platforms, are another part of the shelf. Buyers expect the same clarity here as anywhere else: accurate specs, clean assets, and reliable availability.

The real shopper journey

A real journey might look like this: someone sees your cooler in a TikTok camping video, searches “best camping cooler,” reads reviews on Amazon, checks bundles and warranty details on your DTC site, abandons the cart, then a few days later clicks a retargeting ad and finally buys on Walmart.com because shipping is easier with their subscription.

That’s one purchase decision—but multiple platforms and touchpoints. Any weak link—thin content, bad reviews, out-of-stock status, or confusing pricing on a key step—can derail the sale. Winning the digital shelf means performing consistently across the whole journey, not just in one place.

Key levers that drive visibility on the digital shelf

Not every factor matters equally. A handful of levers move most of the results.

Search rank is the front door. If you don’t appear for the terms people actually use—“wireless earbuds under $100,” “grain-free dog food,” “BPA-free water bottle”—you’re not really in the consideration set. On marketplaces, rankings depend on a mix of sales velocity, conversion, relevance, and reviews. On search engines, feed quality, click-through, and landing page experience matter. Tracking rank for core terms over time shows how changes in content, pricing, and stock are playing out.

Availability is non-negotiable. Going out of stock doesn’t just cost you sales for a few days; it can push you down in results and make recovery slow even after you restock. If you’re paying for traffic to an out-of-stock product, you’re also burning budget and training algorithms that your listing doesn’t convert.

Product content—titles, bullets, descriptions, and structured attributes—drives both search and conversion. It needs to match how customers search and filter, follow each platform’s rules, and capture the qualities that matter most in your category. If your content is incomplete or inconsistent, you simply won’t appear in many filtered results and may be quietly penalized.

Visuals and rich media are your packaging online. A clean hero image that clearly shows what you’re selling is table stakes. Adding multiple angles, lifestyle shots, simple infographics, and a short “how it works” video often meaningfully increases conversions.

A classic pattern: a brand adds 2–3 lifestyle images and a 30-second demo video to a top SKU. Conversion climbs from roughly 3% to 4–4.5% on the same traffic. At scale, that’s hundreds or thousands of extra orders each month.

Reviews and Q&A sit at the intersection of social proof, SEO, and algorithm signals. Low ratings or very few reviews drag performance down. Fresh reviews show the product is still relevant and moving. A well-maintained Q&A section helps people self-serve with sizing, compatibility, and use cases, reducing bounce rates and support requests.

Pricing and promotions shape behavior and how platforms treat you. If your price is clearly out of line with comparable products, you’ll lose the click and the sale. Dynamic pricing, coupons, and time-bound deals can boost visibility and velocity—but they should be used deliberately, not just as a reflex. The goal is to unlock rankings and reviews when it matters, not to train the market only to buy on discount.

Why you need to analyze your digital shelf

Simply being listed ≠ actually performing. You can have full SKU coverage and still lose a significant share of potential sales to competitors who actively manage their shelf space.

Online, your competitors change with each search term and platform. The brands you face on “protein powder” are not precisely the ones you see for “vegan chocolate protein powder,” and both sets look different if you move from Amazon to Walmart or Google Shopping. If you don’t know who’s above you and why, you’re flying blind.

Digital shelf analytics shows where you’re leaking revenue. Content gaps, weak reviews, uncompetitive pricing, and stockouts usually don’t announce themselves; they quietly erode performance.

You might see:

- A hero SKU is converting far below the category average.

- A high-volume keyword where you sit just off page one.

- A competitor is undercutting your price and stealing your Buy Box.

- A bestseller that was out of stock on a key retailer for a week while you were still sending paid traffic there.

All of these are fixable once you see them.

Data alone isn’t enough, though. Reports only matter if there’s a process to act on them. You need a simple loop: monitor → spot issues with real revenue impact → assign owners → fix → measure. Without that, even the best dashboards don’t change your results.

What is digital shelf optimization (DSO)?

Digital shelf optimization (DSO) is the ongoing effort to improve the factors that determine whether shoppers find, click, and buy your products across digital channels.

In practice, that means:

- Keeping product data clean, complete, and consistent.

- Continuously improving titles, content, and assets.

- Watching stock and fulfillment so products are available where demand is.

- Keeping prices competitive but strategic.

- Building and protecting firm review profiles and Q&A.

- Using retail media to amplify listings that already convert well.

Done well, DSO delivers very tangible outcomes: more revenue through better search and conversion, higher share of shelf versus competitors, fewer lost sales from stockouts or broken listings, and lower returns because expectations are clearer. It’s not just a marketing task; it touches product, supply chain, merchandising, and analytics.

Step-by-step digital shelf strategy

You don’t fix the digital shelf with one big project. You build a system. Here’s a practical sequence.

1. Centralize and clean your product data.

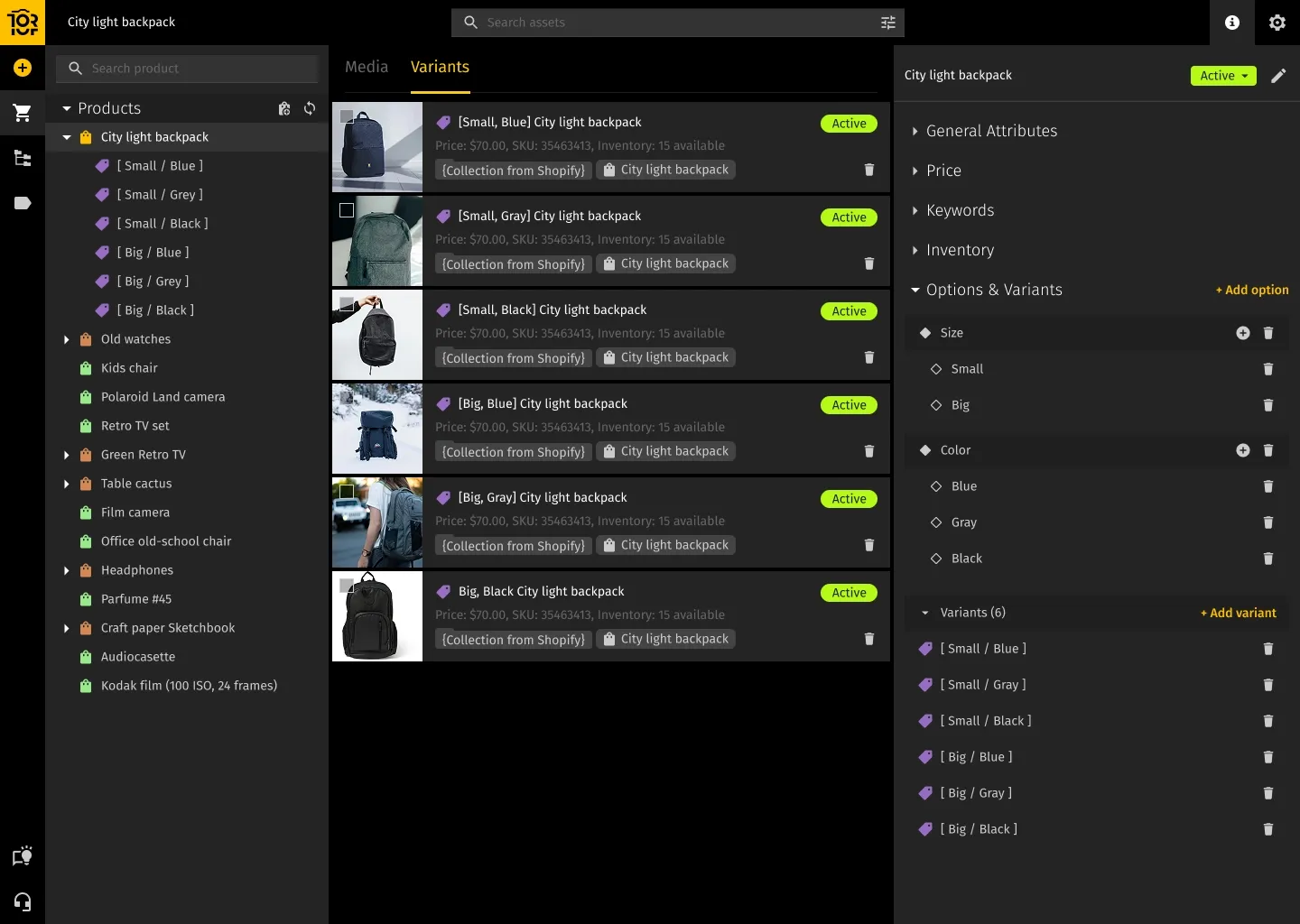

If product info lives in spreadsheets, CMS fields, and separate marketplace accounts, updates are slow and error-prone. The first step is moving to a Product Information Management (PIM) system as your single source of truth for SKUs, variants, attributes, specs, categories, and relationships. Connected to a Digital Asset Management (DAM) system for images and media, a PIM lets you push consistent data everywhere instead of fixing the same mistake ten times.

2. Map your key channels and “must-win” shelves.

Not every platform or query is equally essential. Look at where customers actually shop today and where your highest upside is. For each priority channel, identify your critical categories and search terms, along with the hero SKUs or ranges where winning would drive the most revenue. It’s better to dominate a small set of must-win combinations than to be average everywhere.

3. Improve search rankings.

Do keyword research to understand how people really describe your products. Use those phrases in titles, bullets, and descriptions; make sure products sit in the right categories and browse nodes. On the search side, keep feeds clean and structured so Google and other engines can read them. Track rank for core terms and adjust content, images, and pricing based on what you see.

4. Optimize product pages for conversion.

Once people arrive, the PDP has to close the sale. Review your pages: are the images sharp and informative? Do they show the product in context? Is the description straightforward to scan? Are specs complete and accurate? Treat each PDP like a landing page. Test hero images, bullet order, and messaging. Small lifts in conversion compound fast at scale.

5. Prioritize reviews and feedback.

Reviews don’t just appear on their own. Create a simple, repeatable process to request them after purchase, respond to negative feedback, and update content when the same complaint recurs. Watching competitor reviews is useful too: they surface pain points in the category that you can address in product design or messaging.

6. Build a smart pricing and promotions playbook.

Decide how you’ll monitor competitor pricing, how far you’re willing to move, and when promotions make sense. Automate what you can with pricing tools, but keep strategy in your hands: when to push for share, when to protect margin, and when to use bundles, subscriptions, or value-adds to justify a premium.

7. Use retail media to amplify what already works.

Paid placements work best when they sit atop strong organic fundamentals. If your PDP converts well, reviews and pricing are solid, and retail media can push you to the top of key pages, help defend branded searches, and accelerate launches. If the listing itself is weak, paid clicks mostly turn into expensive bounces.

8. Make optimization continuous and cross-functional.

Build a rhythm around all this. Set up regular check-ins to review rankings, conversions, reviews, and stock issues. Run short sprints focused on fixing specific problems or reacting to competitor moves. Make sure e-commerce, marketing, product, and supply chain all know what they own. The brands that bake DSO into their weekly operating system gradually pull away from those that revisit it once a quarter.

Typical mistakes in managing the digital shelf

Even mature brands fall into a few predictable traps:

- Treating the digital shelf as a one-off project: listings go live, everyone moves on, and nothing changes while competitors keep optimizing.

- Keeping product data scattered across tools and teams means that every change is slow, and inconsistencies creep in everywhere.

- Ignoring platform-specific rules for attributes, formats, and images results in suppressed, rejected, or underperforming listings.

- Collecting endless reports with no clear owner for fixing what they reveal.

- Neglecting data quality and compliance topics—like allergens, regulatory labels, or sustainability claims—and ending up with both performance problems and legal risk.

All of these are solvable with a solid data foundation and transparent processes, but they don’t fix themselves.

Tools and tech stack for digital shelf optimization

You don’t need every tool out there, but you do need a basic stack that makes managing the digital shelf realistic at scale.

At the core are a PIM to store structured product data and a DAM to store images, videos, and other assets. Product Experience Management (PXM) layers on top to adapt content for different channels and audiences without breaking consistency.

On top of that core:

- SEO and marketplace tools such as Helium 10, Jungle Scout, or SEMrush help you understand keyword demand, track rankings, and spot opportunities.

- Digital shelf analytics platforms like Profitero, Stackline, or CommerceIQ show where you appear relative to competitors, how your prices compare, whether your content meets requirements, and where reviews or stock are slipping.

- Pricing and repricing tools monitor competitor prices and help apply rules, rather than requiring every change to be made by hand.

- Review and CX tools like Bazaarvoice, PowerReviews, or Yotpo help you collect, syndicate, and analyze feedback.

The best stack is the one that integrates with your existing systems and automates the highest-impact workflows, rather than adding tools to tick boxes.

FAQ

What is digital shelf software?

Digital shelf software is a collection of tools that help brands monitor, manage, and improve how their products appear and perform across online retailers and marketplaces. It usually includes systems for managing product data and assets, platforms that track rankings and share of shelf, tools for pricing and promotions, and solutions for collecting and managing reviews. The goal is to give teams a clear view of what’s happening on the shelf and the ability to act on it quickly.

Why is the digital shelf essential?

The digital shelf decides whether shoppers see and choose your products when they buy online. If you rank poorly in search, have weak content, lose on price, or suffer from bad reviews, you’re effectively invisible—even if your product is strong. When your digital shelf is in good shape, you gain visibility, lift conversion, collect more positive reviews, and ultimately grow revenue and share.

What is digital shelf data?

Digital shelf data is the set of metrics that describe your online presence: where you rank for key search terms, how your prices compare to competitors, how often you’re in stock, what ratings and review volumes you have, how complete your content is, and how often you appear on important category or search pages. Together, this data shows where you’re winning, where you’re exposed, and which fixes will have the most significant impact.

What is digital shelf marketing?

Digital shelf marketing is the set of tactics used to improve discoverability and conversion of your products on e-commerce platforms. It combines SEO, on-page content optimization, retail media campaigns, and competitive monitoring, all adapted to each channel—marketplaces, search engines, social commerce, or your own site. The focus is on performance at the moment shoppers decide what to add to their cart.

What does a good digital shelf strategy consist of?

A strong digital shelf strategy brings together a clean, centralized product data foundation, channel-specific content and feed optimization, continuous tracking of search rank, conversion, reviews, and stock, clear rules around pricing and promotions, and regular cross-functional processes to fix issues and test improvements. It works as a system rather than a one-off campaign.

Conclusion

The digital shelf is a long-term capability built from data, content, pricing, operations, and analytics working together. When you treat your own digital shelf as a long-term capability, you can align digital shelf management, content, inventory management, and advertising strategies into one coherent system that supports your broader eCommerce strategy.

Platforms, algorithms, and shopper behavior will keep changing, but the basics stay the same: clean data, compelling product pages, competitive and thoughtful pricing, strong reviews, and fast execution win. Brands that treat this as part of how they run the business will keep capturing share while others fade from view.

A practical way to start:

- Audit your current digital shelf. Where do you rank for top keywords? How do your PDPs compare to your strongest competitors? What do your ratings, review depth, and stock history look like on key channels?

- Choose a small number of must-win shelves. Pick two or three channels and a handful of hero SKUs or categories, and focus your effort there instead of trying to fix everything at once.

- Strengthen your product data foundation. Move toward one reliable source of truth for product information and assets so every optimization you do is faster and easier to scale.

Once that base is in place, every hour you spend on optimization works harder—and the digital shelf becomes a lever you can pull on purpose, not just something that happens to you.

The goal is to stop treating it as a black box and start thinking of it as “my digital shelf” – something you can design, measure, and deliberately improve over time.

Akinai Alieva

Akinai is a Customer Success Lead with a background in international business and UX/UI design. She has managed customer support teams of 5+ people, led process improvements, and boosted retention through onboarding, email campaigns, and UX writing. With UX research training and a RadCode award-winning design project, she consistently brings the customer’s voice into conversations with product teams and senior leadership.